How to Qualify for a Second Hand Car Loan in 9 Easy Steps

Getting approved for a second hand car loan involves a series of calculated steps. Understanding the requirements and efficiently organising your application can improve your chances of approval. For instance, lenders typically look for credit scores above 600 as a baseline for considering loan approvals, with better rates often reserved for scores over 700.

Additionally, a down payment of at least 20% of the car’s value is generally recommended to secure favourable loan terms. It’s also vital to consider the debt-to-income ratio, with most lenders preferring a ratio below 40% to ensure that borrowers have enough income to manage their second hand car loan repayments comfortably.

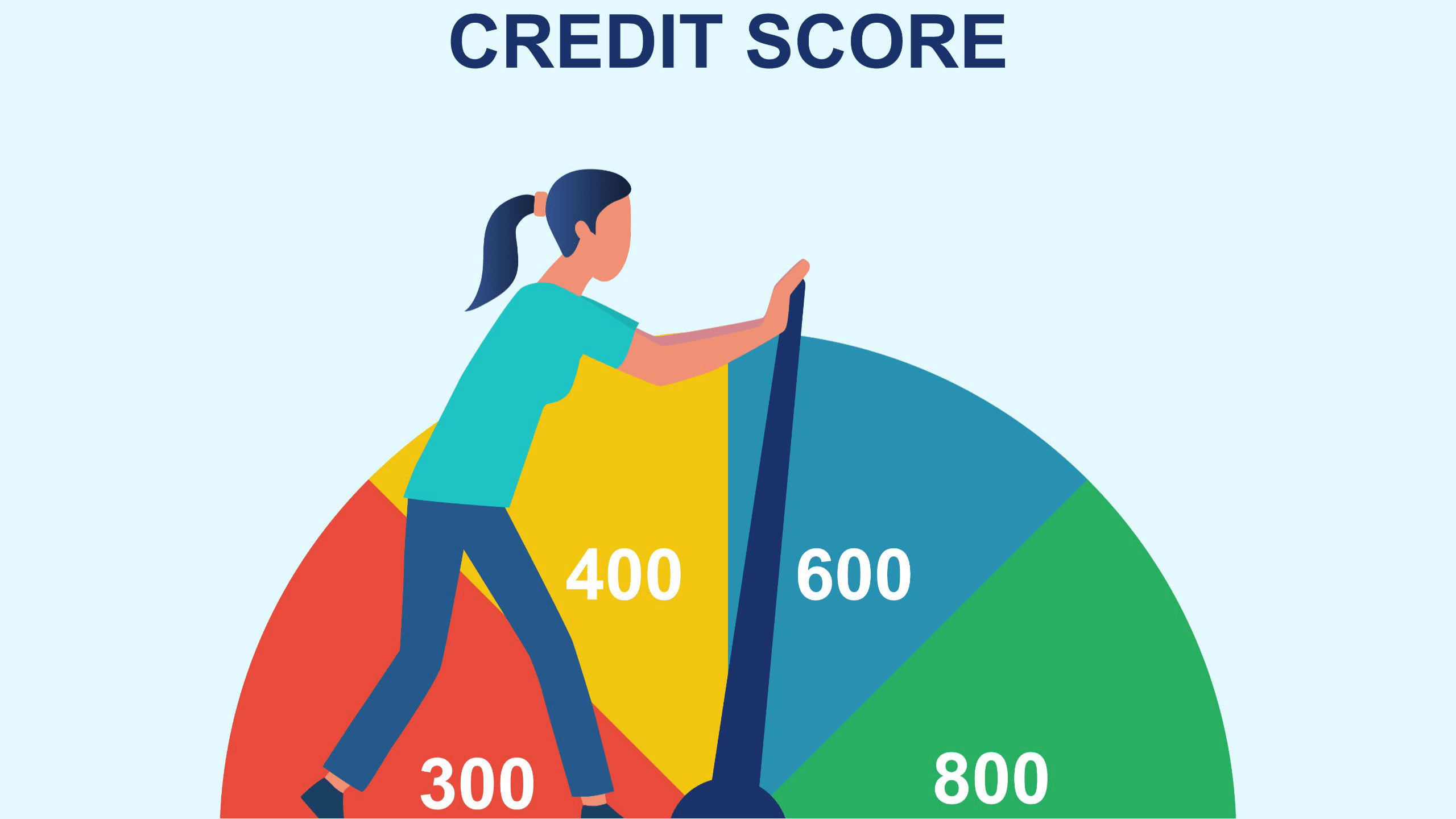

Step 1: Credit Score

Check your credit score before you race off to get a second hand car loan. It’s like the heartbeat of your financial health, crucial for loan approval. A good score can get better loan terms.

Here’s how to rev it up:

- Regular Check-ups: Get a free credit report from major credit bureaus annually to catch any errors.

- Debt Management: Pay down existing debts to improve your credit utilization ratio.

- Timely Payments: Ensure all bills and existing loans are paid on time to avoid dents in your score.

Working on your credit score increases your chances of a positive response on loan eligibility.

Step 2: Calculating Your Financial Mileage

Setting a realistic budget for your second hand car is vital. More than the purchase price, remember to consider loan repayments, fuel, maintenance, and insurance. Here’s how to calculate:

- Total Costs: Estimate the total cost of ownership, including the loan interest over time.

- Monthly Repayments: Use an online loan calculator to understand your monthly pay.

- Emergency Buffer: Keep room for unexpected repairs or maintenance in your budget.

Creating a comprehensive budget ensures your car purchase won’t run your finances off the road.

Step 3: Picking the Perfect Ride

Finding the right second hand car is about balancing desire with practicality. Consider what you need the car for, your budget, and critical factors like:

- Mileage: Lower might mean less wear and tear, but don’t dismiss a well-maintained, higher-mileage car.

- Age: Newer models may have more advanced features, but weigh this against the price.

- Condition: Always get a potential purchase checked by a professional to avoid costly surprises.

Step 4: Selecting the Right Lender

Choosing the right lender for your second hand car loan is important. You want someone reliable and understanding of your needs. It’s essential to look around, compare interest rates, review loan terms, and read customer reviews. A reputable lender will offer competitive rates, transparent terms, and excellent customer service, guiding you smoothly through the loan process.

Step 5: Understanding Loan Terms

Understanding the loan terms is crucial before you sign on the dotted line. Key terms include the interest rate, loan duration, monthly repayments, and any fees or penalties for early repayment. Make sure these terms align with your financial goals and budget.

Choosing the correct second hand car loan terms can significantly affect how comfortably you can manage repayments, ensuring a smooth ride on your financial journey.

Step 6: Preparing Your Documents

You must get your documents in order before driving away in your second-hand car. Here’s a checklist to help you prepare:

- Proof of identity (ID card, passport).

- Proof of income (payslips, bank statements).

- Proof of residence (utility bill, rental agreement).

- Vehicle details you wish to purchase.

- Insurance documents.

Having these documents compiled will speed up the loan application process, bringing you one step closer to securing your second hand car loan.

Step 7: Securing the Best Loan Deal

Don’t hesitate to negotiate the terms of your second hand car loan. With offers from various lenders, you’re in a strong position to discuss and secure the best deal. Highlight competitive rates you’ve found elsewhere to encourage better offers and don’t be shy about asking for lower interest rates or waived fees. Remember, negotiation can lead to significant savings over the life of your second hand car loan.

Step 8: Submitting a Strong Application

Accuracy and completeness are critical to a strong loan application. Ensure all sections are filled out correctly, and you’ve included all required documents. Double-check your application before submission to avoid delays. A well-prepared application can significantly speed up the approval process, getting you closer to securing your second-hand car.

Step 9: Closing the Deal

Once your second hand car loan is approved, there are a few final steps before you can drive away in your new (to you) car. This includes ensuring vehicle inspection meets your standards, securing insurance, and signing the loan agreement. Pay close attention to the details during these final stages to ensure everything is in order. A thorough approach here can save you from any last-minute issues.

Explore Second Hand Car Loan Today

Getting a second hand car loan is more achievable than you might think. If you follow the mentioned steps, you’re well on your way to taking control of your car-buying journey. Now is the perfect time to implement this knowledge and move closer to owning the car that meets your needs and budget.

For a seamless financing experience, consider exploring the loan solutions available with Tata Capital. They’re committed to helping you find the right loan with terms that work for you, making the process straightforward and stress-free. Start exploring your options today!