The Impact of AI Avatars in Financial Services

Money activities, like banking and investing, are called financial services. These services help people, businesses, and the community by managing, creating, and exchanging money. They are important for making the economy grow and stay stable.

But understanding financial services can be hard because they need a lot of knowledge and skill. They also change a lot because of things like technology, rules, and competition.

AI and Financial Services

Artificial intelligence (AI) is changing how financial services work. AI is a part of computer science that focuses on making machines do things that usually need human smarts, like learning and making decisions. There are two kinds of AI: narrow AI and general AI. Narrow AI does specific tasks like playing games or recognizing faces. General AI, which can do anything a human can, is still an idea for the future, while narrow AI is already happening.

AI Avatars

AI in financial services can be used in a cool way called AI avatars. These are like digital versions of people made and managed by AI. AI avatars help in talking and working with customers, employees, and partners in finance. They can do things like customer service, giving personal financial advice, and analyzing data.

Applications of AI Avatars in Financial Services

AI avatars in finance have many uses. They can help with customer service, giving personalized financial advice, and analyzing data. They’re like digital assistants for different money-related tasks.

Customer service

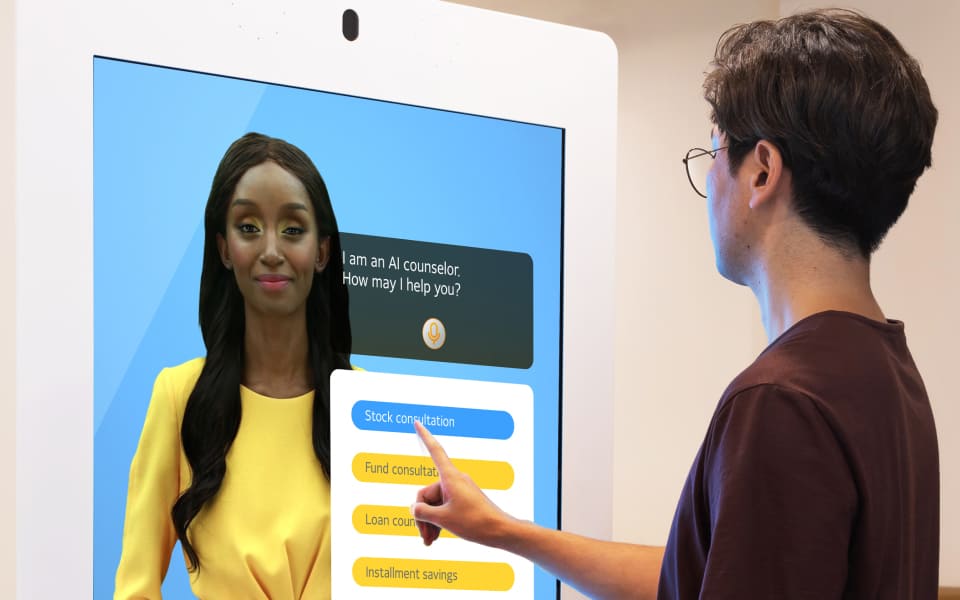

Customer service is about helping and supporting people when they buy or use something. In finance, it’s super important to keep customers happy. AI avatars can be like smart digital helpers, talking to customers in a friendly way. They can answer questions, fix problems, and tell you about your account balance and transactions. It’s like having a helpful friend online.

Personalized financial advice

Personalized financial advice is like getting special guidance tailored just for you based on what you want to achieve with your money and what you need. This kind of advice is super useful for financial services because it helps customers make smart decisions. AI avatars can provide this personalized advice by looking at your income, spending habits, assets, and debts. They use their language skills to advise on budgeting, saving, investing, and borrowing. They make it simple for you to understand and act on.

Data analysis

In finance, it’s important because it can make things work better, faster, and more creatively. It also helps to find and handle risks and opportunities. AI avatars can do data analysis by learning from big and complicated sets of data using machine learning and deep learning. They can discover new things in the data, like patterns and predictions. Then, they use natural language and visuals like charts and graphs to explain what they found. It’s like having a smart assistant for understanding and using data.

Benefits of AI Avatars in Financial Services

AI avatars offer lots of good things for financial services. They make things faster and more affordable. They improve how customers feel about the service. They also help in analyzing data to make better decisions.

Efficiency and cost-effectiveness

AI avatars are like smart assistants that can make financial services work better. They use AI to do things faster and cheaper, like helping customers. They give personalized money advice and analyze data.

Improved customer experience

They provide better and improved customer experience. They use natural language, speech, and facial expressions. Also, they understand and respond to customers’ emotions. AI avatars can analyze data and predict what services are best for customers. This makes the advice and service more fitting for each customer’s goals and preferences.

Data analysis for better decision-making

AI avatars can be like smart helpers for making better choices in finance. They use AI to look at data, find useful information, and help with decision-making. These AI avatars can make financial services work better by analyzing data, making things more efficient, and finding new ideas. They also look for risks and chances to help.

Not just that, these AI helpers can assist customers in making wiser money decisions and reaching their financial goals.

DeepBrain’s AI Avatars

DeepBrain is a company that gives AI solutions all around the world. They have different tools and services that use AI in areas like healthcare, education, entertainment, and finance. DeepBrain’s AI Avatars are like computerized versions of people that AI can make and control. These avatars can be handy in finance for talking to customers, employees, and partners. They can be used in different financial situations.

DeepBrain’s AI Avatars are like helpful assistants that can assist customers. They can answer questions, solve problems, and share information. They can help based on how much money is in an account, what transactions were made, and details about products. These AI Avatars can even offer personalized financial advice. They provide advice on budgets, investments, and debts based on this information.

DeepBrain’s smart AI Avatars can help understand and make sense of large amounts of information. They learn from this data to show patterns, trends, and predictions. This helps financial services work better. They help to save time and money. They make customers happier and improve decision-making.

Future Outlook

AI avatars are computerized helpers that are already making a good difference in finance. They’re not just changing things now but creating the future of finances too.

One way that AI avatars help is by being financial advisors. They can watch over and manage people’s money, and then tell them if anything important happens.

Another way that AI avatars help is by being financial teachers. They can make fun lessons that help people learn about money, and then test them to see how much they’ve learned.

Finally, AI avatars can also be financial thinkers. They can use their skills to make new and better money ideas, like reports, predictions, and suggestions. This can help people and businesses make smarter financial choices.

Conclusion

AI avatars are computer programs that help with banking, investments, and other financial things. They can make it easier and faster for people to get help with their money. AI avatars can also create new tools and ideas for managing money better. In short, AI avatars are changing how people do money stuff.

What do you think about AI avatars in finance? Are they good or bad? Have you ever used or made an AI avatar for money stuff? Please tell us what you think in the comments below.

Thanks for reading and have a great day!